Automobile credit

B2C / Web solution

“We need our customers to perceive agility and ease in obtaining an auto loan at the car dealerships"

BBVA Credits

- My contributions:

Product discovery

Analysis

Research

Shadowing

Mystery shopping

Navigation flows

Wireframes

Mockups (responsive website)

Prototype

Usability testing

Interface design - Tecnologies:

Sketch

InVision - Client: BBVA - Automotive credits

- Methodology: Design Thinking / SAFe

- Tear: 2020

Context

Currently, in order to apply for an automotive loan, it is necessary to carry out paperwork with the automotive agencies that involves several days with different reviews and paperwork signatures. This process could be tiring, especially considering that customers currently seek and give added value to the immediacy of the services.

Objectives

- Feedback

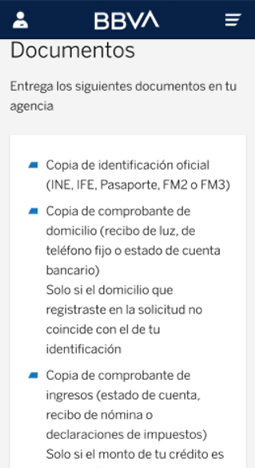

Disclose the total amount to be granted and requirements to give clarity about the complete picture to clients.

- Digital applications

Enable simplified digital applications for greater agility in the process.

- Accessibility

Allow users to apply for their credit from any device for greater convenience.

Solution proposal

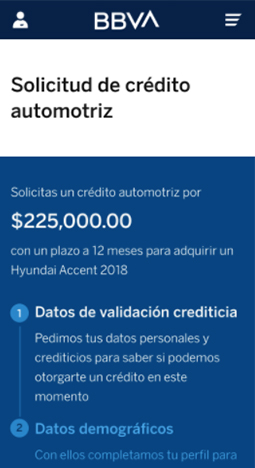

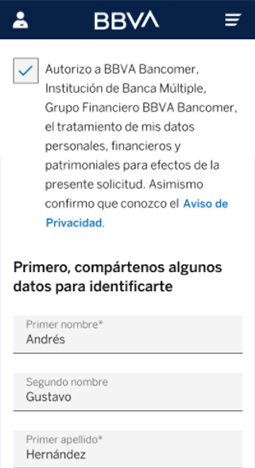

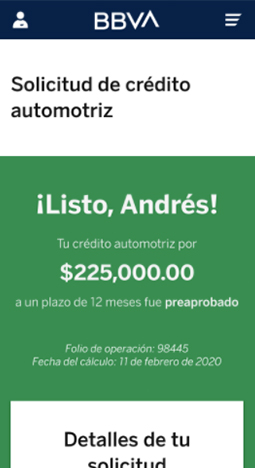

Generate a simplified digital form to key data, allowing potential customers to apply for automotive loans from their mobile device and thus have a real picture of the credit conditions they could obtain.

Personas

Individuals interested in acquiring a car through an auto loan.

Meet Leticia

41 years old - Teacher

Use of digital tools: intermediate level

Leticia is an independent woman and mother of 3 children. She wants to have practical options to solve her daily life so she can enjoy her family.

This solution would help Leticia to easily identify the type of credit she could acquire according to her budget, to buy a car model that would allow her to take care of her children, do her shopping and streamline her daily life.

Meet Andrés

28 years old - Mathematician

Use of digital tools: advanced level

Andrés is a very curious and sociable guy. He wants to take advantage of being single to start buying things that will allow him to have a more comfortable life.

This solution would help him to quote his first car according to his possibilities to move everywhere he wants to go.

Meet Alfonso

55 years old - Architect

Use of digital tools: basic level

Alfonso is a conservative and analytical man. He wants to have comfort and streamline his business transfers.

This solution would help Alfonso identify the right car model to use at all times, both for work and for his personal life.

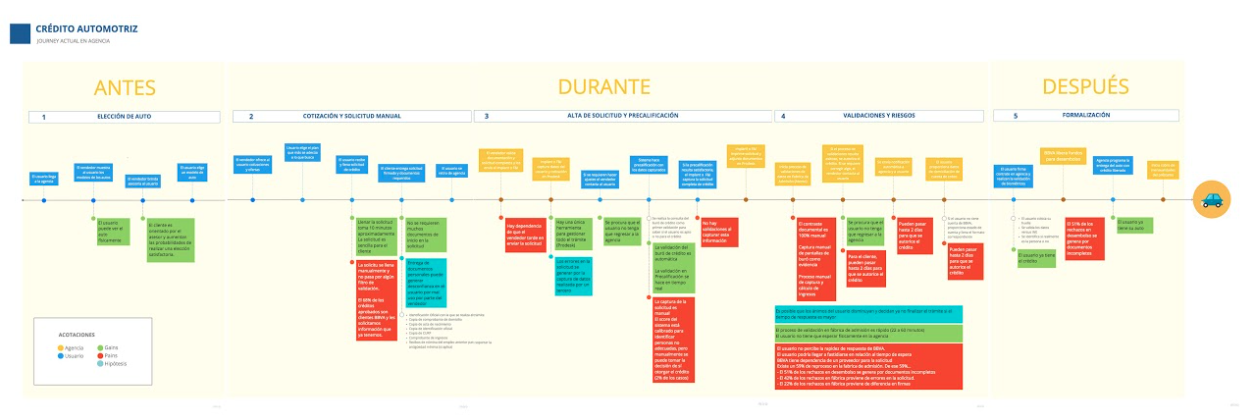

Research, user journey map and shadowing

Based on an initial research process, I elaborated a user journey map that shows the AS IS of the process to obtain an automotive loan before the proposed solution.

- Understanding sessions with the client, a leader focused on automotive credit, two people from the risk area in the credit authorization process, and two people from the risk area in the credit authorization process.

- One shadowing session directly at the car dealership

- 4 interviews with sales agents in car dealerships

- 3 mystery shopping sessions in car dealerships

This material was key to identify the specific pains at each stage of the process and the impact it had on the loss of potential customers or customers who were interested but ended up buying from the competition.

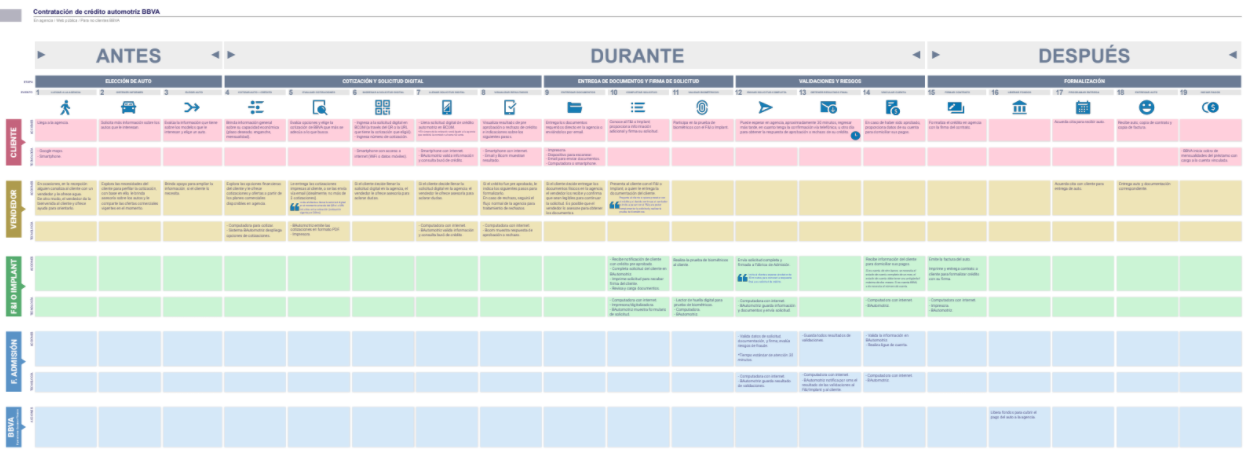

Service blueprint

Based on these results and contrasting with the patterns identified throughout the research, I developed a Service Blueprint that rigorously maps the entire process, actors and technologies involved in the new TO BE process of applying for an automotive loan, considering a digital, simplified and responsive solution that streamlines the process before potential customers leave the car dealership.

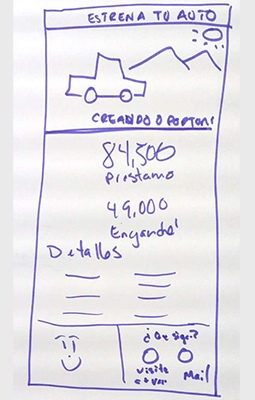

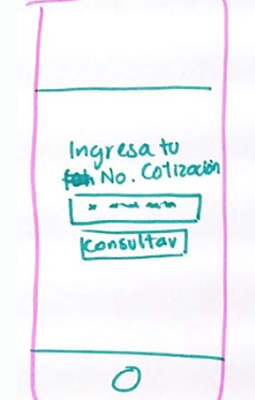

Wireframes

Taking as a reference all the information gathered in the understanding stage, I conducted 2 ideation sessions with the client, a leader focused on automotive credits, two people from the risk area in the credit authorization process.

In those sketches we can identify the key elements that the client considers fundamental to streamline the auto credit application process in the agencies.

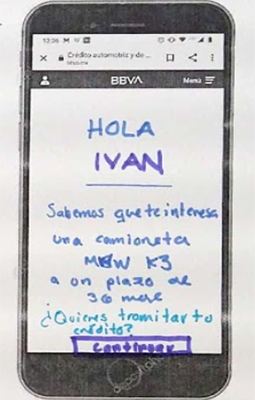

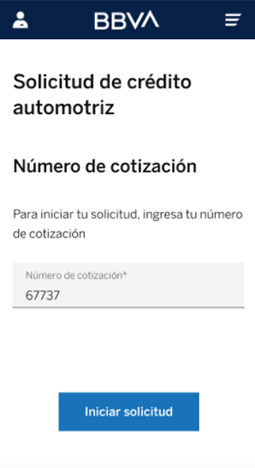

Mockups

Based on all the research done, I designed the digital and responsive solution (desktop, tablet and smartphone), which went through at least 5 reviews with the technical area, the client, a leader focused on automotive credits and two people from the risk area in the credit authorization process.

Usability testing

I conducted 3 cycles of usability testing on 3 different days and with a total of 9 people in individual sessions of 60 minutes each. After each testing cycle (3 sessions), I carried out a new iteration on the designed visuals to finally reach the solution.

At the end of each usability test I applied a standard SUS or System Usability Scale usability survey, averaging everything with a score of 95, which positions the solution at an "excellent" level of usability for the users.

Takeaways

Observation

This project is part of a very competitive environment or "red sea", as there are currently many agencies offering practically the same thing with different conditions. My mission was to clearly identify the key vanishing point where potential customers may give up and leave without concluding with taking out an auto loan with BBVA.

Immediacy

The solution I designed went through a very rigorous process of reviews not only by me, but also by different areas of the bank and of course, the end customer. With this I guaranteed that the solution is not only easy to use, but that people could truly leave the agency with pre-approved credit in a matter of minutes, which represents a great differential in relation to the business model of the highly competitive industry.