Digital receipt

B2C / Physical and digital solution

"We need to take better care of the environment and save money in the printing of payment receipts from the POS (Point of Sale Terminal)"

Payment methods BBVA

- My contributions:

Product discovery

Analysis

Research

Mockups

Prototype

Usability testing - Tecnologies:

Sketch

InVision

Point of Sale Terminal (POS) - Client: BBVA - Payments

- Metodology: Design Thinking / SAFe

- Year: 2021

Context

BBVA currently spends 32 million pesos in thermal paper to print promissory notes that have no official validity for the customer, since the account statement is necessary to make any kind of clarification.

On the other hand, for the vast majority of users, keeping the accounting of their expenses from promissory notes is an impractical task.

Objetives

- Savings

Cost savings for BBVA in the printing of promissory notes (30 million pesos in annual paperless).

- Understanding

Understand the needs of merchants to generate payment vouchers, as well as the appropriate digital media to deliver the voucher to customers.

- Practicality

Generate a digital solution that allows all BBVA customers to consult their promissory notes in a practical way.

Solution proposed

Generate a solution in a digital channel where BBVA customers who pay with TDD (Debit Card) or TDC (Credit Card), can consult their promissory notes digitally.

Personas

Individuals who make payments with TDD (Debit Card) or TDC (Credit Card) in physical establishments (not digital payments).

Meet Juan

27 years old - Architect

Use of digital tools: advanced level

Juan is an extroverted and relaxed guy. He likes to experiment and always adopt new ways of doing things with the support of technology.

This solution would help him to know in a new, faster and more practical way, the information of his expenses and balance; it would also help him to keep this data digitally.

Meet Andrea

36 years old - Real estate

Use of digital tools: intermediate level

Andrea is a cautious person. She wants to have a documented folder of all the procedures and receipts she obtains, to have a backup in case she needs to make some kind of clarification.

This solution would help her to immediately confirm the payment made digitally, as well as to have a digital receipt that is not erased over time, allowing her to protect herself from possible fraud in the payments she makes.

Meet Norma

49 years old - Administration

Use of digital tools: low level

Norma is a methodical and structured person. She wants to have a meticulous administration by taking advantage of different physical or digital tools.

This solution would help her to have a digital record of all her expenses, allowing her to monitor all her movements and plan her movements in a more practical way.

Anatomy of the initial promissory note

Based on specific interviews with experts in Point of Sale Terminals, I elaborated a diagram of a current promissory note, which shows exactly the data that is currently printed when a payment is made. All this information comes from different services that specifically belong to 3 key players:

- The intermediary or clearing house that is responsible for linking the payment from the sender to the receiver.

- The Point of Sale Terminal (POS) which is the device used by the establishment to receive payments.

- The Credit/Debit Card that the customer hands over when making a payment.

Interviews

Based on this diagram, I approached each of the 3 corresponding areas to identify the purpose of the data that is printed and to find out which are priority or indispensable in the promissory note.

I also conducted individual interviews of 60 minutes each, with 16 individuals who make payments with credit or debit cards. These interviews were very helpful in identifying the data that are of greatest value to users and what they use them for. They were also fundamental approaches to know the level of importance that promissory notes have for each type of user and how they would feel if they stopped receiving them.

In the interviews with users I identified 4 main profiles within the 3 categories of users:

- Hoarders keep the promissory note out of caution or concern that their information will be misused, however they dispose of these papers when they no longer fit in their wallet.

- The careless ones only verify the amount of the purchase and then throw the note away because they trust the digital information their bank gives them.

- The organized ones keep the note to control their expenses and have good financial health. They keep the note to make sure they don't get double-charged.

- Those who are accountable keep the promissory note to give to their accountants and/or prove expenses.

Visual

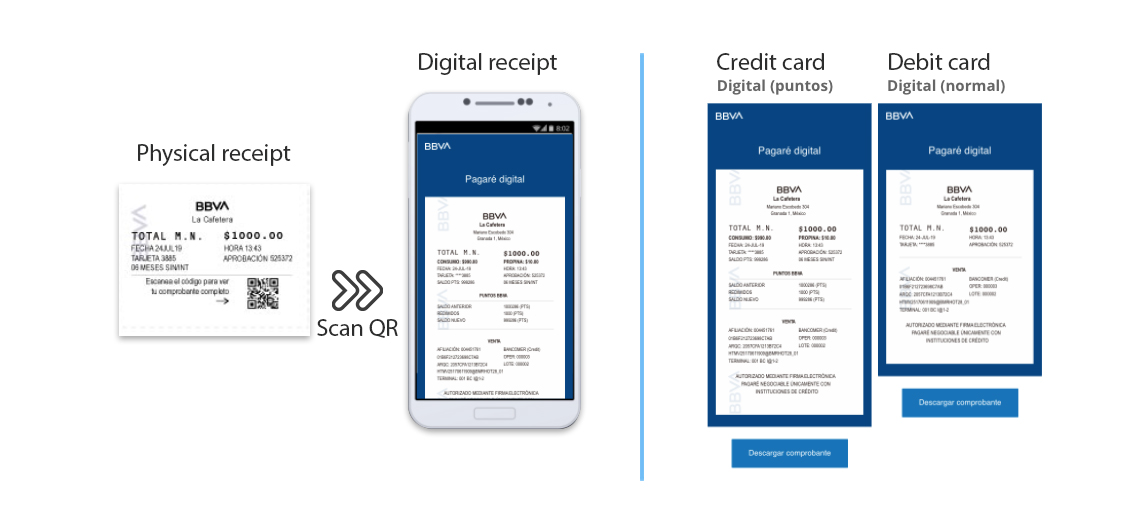

Taking as a reference all the information gathered in the understanding stage, I generated a new, more simplified design of the promissory note that has the most important data for the users and the bank in view. This promissory note has a QR that would lead to a digital payment voucher with all the details. The prototype was built with a real Point of Sale Terminal (POS).

Usability testing

I conducted 14 usability tests in individual sessions, each lasting 30 minutes, with individuals who make payments by credit or debit card. 9 of the participating users decided to print their promissory note, while the other 5 chose not to print it because they did not consider it relevant.

At the end of each usability test I applied a standard usability survey SUS or System Usability Scale, averaging everything with a result of 85, which places the solution at an "excellent" usability level.

Migration

Thanks to profile identification some people are afraid of losing it and a migration from physical to digital promissory notes will be carried out progressively in 3 stages:

- In an initial stage a smaller physical promissory note will be provided, but the customer has the option to choose whether he wants it or not.

- In a second stage, an even more simplified promissory note with a QR that would display the rest of the complementary data in a digital voucher will be optionally provided.

- In the final stage a physical promissory note would not be provided unless the customer requests it and all the information of the payments made, will be on the digital vouchers.

Takeaways

Confidence

The main reason people decided to print the promissory note was because they wanted to be sure that the collection was made for the correct amount without the possibility of scams. In designing the solution, it was essential to highlight those pieces of information that help customers have peace of mind that their payments are made in the right way.

Evolution

Although there are many people with a low level of technological proficiency, I realized that they are always willing to learn how to leverage new digital tools to their advantage. My mission in this project was to propose a gradual and friendly migration to digital receipts, for users of all ages and profiles.